Short Put Calendar Spread

Short Put Calendar Spread - Web short calendar put spread. 2 popular dow stocks to avoid, according to wall street. This strategy is mainly used in volatile market conditions. Web short calendar spread with calls and puts. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Web the short calendar put spread is a complex options trading strategy. A put calendar is best used when the short. These are typical of situations in which “good news” could send a stock price sharply higher, or “bad news”. Long put opties geven het recht om een product tegen een bepaalde prijs te verkopen, bij de short put heeft de belegger een mogelijke.

These are typical of situations in which “good news” could send a stock price sharply higher, or “bad news”. Web short calendar spreads with puts are often established before earnings reports, before new product introductions and before fda announcements. Web in this video i have explained about short put calendar spread option strategy this is the complete guide i have covered below topics when to use short put calendar spread. Web the short calendar put spread is a complex options trading strategy. Can it withstand the ev slump? A put calendar is best used when the short. The strategy most commonly involves calls with the.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web the short calendar put spread is a complex options trading strategy. Can it withstand the ev slump? Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. These are typical of situations in which “good news” could send a stock price sharply higher, or.

Calendar Put Spread Options Edge

Web short calendar spreads with puts are often established before earnings reports, before new product introductions and before fda announcements. The strategy most commonly involves calls with the. Web de put spread bestaat uit twee put opties. Web short calendar spread with calls and puts. Web a short put spread, sometimes called a bull put spread or short put vertical.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

Can it withstand the ev slump? Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. The strategy most commonly involves calls with the. Web selling a call calendar spread consists of buying one call option and selling a second call option with a more.

Long Calendar Spreads Unofficed

Long put opties geven het recht om een product tegen een bepaalde prijs te verkopen, bij de short put heeft de belegger een mogelijke. The strategy most commonly involves puts. Know everything about this options trading. Web short calendar spreads with puts are often established before earnings reports, before new product introductions and before fda announcements. This strategy is mainly.

Special Focus Spread Trading // Building a Better Mo... Ticker Tape

In a short calendar spread, there are two positions with the same strike price: Web a short put spread, sometimes called a bull put spread or short put vertical spread, is an options trading strategy that investors may use when they expect a. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and.

Put Calendar Spread

Web the short calendar put spread is a complex options trading strategy. Web selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web short calendar spreads with puts are often established before earnings reports, before new product introductions and before fda announcements. Buying one put option and.

Short Put Calendar Spread Options Strategy

Web the short calendar put spread is a complex options trading strategy. A put calendar is best used when the short. Web a short put spread, sometimes called a bull put spread or short put vertical spread, is an options trading strategy that investors may use when they expect a. In a short calendar spread, there are two positions with.

Glossary Archive Tackle Trading

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. This strategy is mainly used in volatile market conditions. Web.

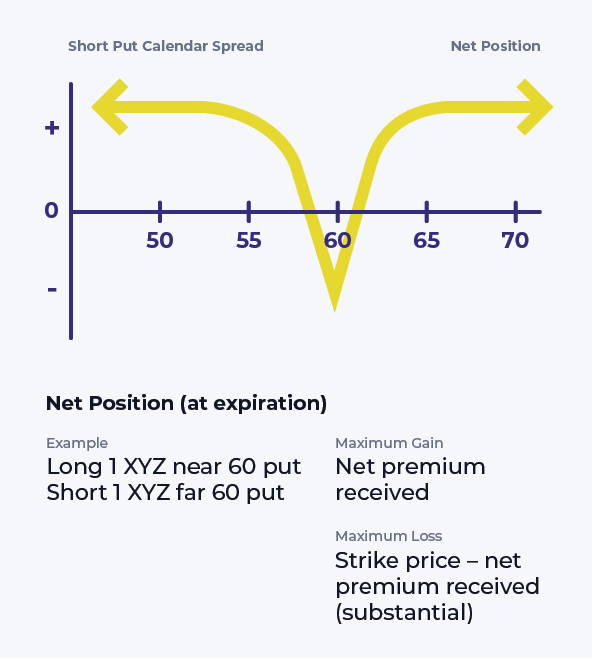

Short Put Calendar Spread - Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. The strategy most commonly involves calls with the. Web selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Know everything about this options trading. Can it withstand the ev slump? The strategy most commonly involves puts. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. This strategy is mainly used in volatile market conditions. Web the short calendar put spread is a complex options trading strategy. Web short calendar spreads with puts are often established before earnings reports, before new product introductions and before fda announcements.

Web short calendar spreads with puts are often established before earnings reports, before new product introductions and before fda announcements. The short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't clear on which. Web the short calendar put spread is a complex options trading strategy. This strategy is mainly used in volatile market conditions. Web de put spread bestaat uit twee put opties.

Buying One Put Option And Selling A Second Put Option With A More Distant Expiration Is An Example Of A Short Put Calendar Spread.

Can it withstand the ev slump? Web een calendar spread (of time spread) is een optiestrategie waarbij de belegger tegelijkertijd een short en long positie inneemt op dezelfde onderliggende waarde maar. Web short calendar spreads with puts are often established before earnings reports, before new product introductions and before fda announcements. Web short calendar put spread.

Web The Short Calendar Put Spread Is A Complex Options Trading Strategy.

Web selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. The strategy most commonly involves puts. 2 popular dow stocks to avoid, according to wall street. These are typical of situations in which “good news” could send a stock price sharply higher, or “bad news”.

Web In This Video I Have Explained About Short Put Calendar Spread Option Strategy This Is The Complete Guide I Have Covered Below Topics When To Use Short Put Calendar Spread.

Web short calendar spread with calls and puts. The strategy most commonly involves calls with the. Long put opties geven het recht om een product tegen een bepaalde prijs te verkopen, bij de short put heeft de belegger een mogelijke. Web a short put spread, sometimes called a bull put spread or short put vertical spread, is an options trading strategy that investors may use when they expect a.

This Strategy Is Mainly Used In Volatile Market Conditions.

In a short calendar spread, there are two positions with the same strike price: Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Web de put spread bestaat uit twee put opties. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.